Take a look at the highlights from last week’s Tilled x Basis Theory webinar on how to get unstuck from status quo processors.

Last week Tilled’s CEO, Caleb Avery, had the opportunity to sit down with Colin Luce, CEO of Basis Theory, to discuss how to break free from those clingy providers (we’re looking at you Stripe & Worldpay) and process payments on your own terms. For those of you who missed it IRL, here’s a recap of what was discussed during the webinar:

As you’re likely aware, the SVB incident is causing quite a stir in the fintech and payments industries. While the crisis has seemingly passed, priorities are shifting in its wake, with redundancy at the top of the list. It’s imperative for all businesses to start thinking about redundancy, but especially so for businesses that are single-threaded through platforms like Stripe and WorldPay. Without any backup options, businesses that leverage these solutions can (and should) feel claustrophobic in today’s environment.

In the past, legacy processors have been known to contractually claim merchant data and tokens as their own. As a result, merchants – who spend money to acquire customers and bring them in – are just licensees of the data they create. Providers like Worldpay will even charge merchants a steep price for tokens if they want to leave and then subject them to lengthy data migration processes as a last-ditch effort to keep them. Stripe took a slightly better approach in that they do actually offer users a migration platform for data, albeit, it’s the provider’s least sophisticated service.

In short, providers like Stripe and Worldpay have combined these perverse business practices with technology that inherently traps users and holds their data hostage. Even though this isn’t unusual in the payment space, you have to wonder when these practices will dissipate as we focus on driving more interoperability, innovation, and flexibility.

“If your retention strategy is holding people’s data hostage, you’ve really already lost.” – Caleb Avery

Get Control of Your Data

Ultimately, knowing where your data is and where it’s backed up can save you a lot of pain later on. When B2B software businesses select a payment provider, they must ask if their data is portable, meaning, can they bring their data with them if they decide to switch providers?

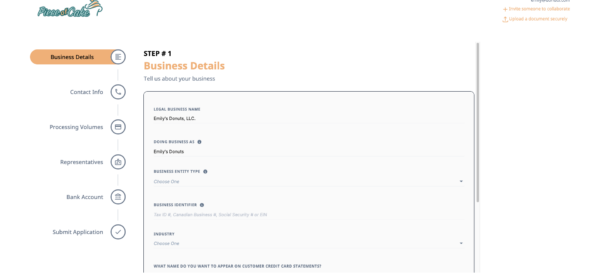

Tilled PayFac-as-Service, for example, will never withhold your data from you.

By partnering with Tilled, you gain a partner who will actually work with you to transfer all of your data if you ever choose to leave for a different platform at any time, for any reason. Tilled also enables businesses to get the best of both worlds between Stripe’s technology and Worldpay’s economics, plus anything else a partner might need to succeed with payments and payment monetization. However, if you’re not utilizing PayFac-as-a-Service, you should at least be protecting your data with a provider like Basis Theory.

Based Theory, a compliance engineering platform, makes it easy for companies to store sensitive data in a PCI-compliant environment and maintain secure access to that data, almost as if it were in-house. With Basis Theory, businesses can become PCI compliant in a matter of minutes rather than weeks or months.

To learn more about how you can take control of your data with providers like Tilled and Basis Theory, follow the respective links below!