With talks of providers like Stripe and Adyen eyeing the mid-market, software companies can rely on Tilled’s PayFac-as-a-Service to deliver an integrated payment solution made for their growing businesses.

The payments industry is no stranger to change. Every other week it seems like there’s a new way to pay, another player introduced to the ecosystem, or advancements in technology that shift the landscape. We’re even seeing industry incumbents like Stripe and Adyen start to go after the mid-market —a move to be expected in their evolution.

Stripe and Adyen have long dominated in their own corners of the market. However, for them to shift their focus upmarket and downmarket, respectively, will be interesting. We’re not here to say that these providers won’t achieve any sort of volume, because they absolutely will, but they will also struggle to reach the level of influence they’ve seen historically. Why? Because selling to mid-market ISVs is just not in their DNA. Let’s consider the following:

It’s Not Hard to Outgrow Stripe

There’s a reason our most popular blog is the one that covers signs you’ve outgrown Stripe. It’s simple, really; Stripe’s system was designed to cater to startups (think two guys in a garage). They’ve achieved success in the market by providing this demographic with the technology and guidance they need to embed payments with as little as 7 lines of code. In order to allow for such simple integrations, startups willingly accept Stripe’s opinions on how to run payments within their business.

Yet, as startups gain momentum and begin to scale, they want to customize their payment experience and add their branding front and center. They start to realize the importance of monetizing their payments and adding new functionality like card present terminals (long considered Stripe’s achilles heel), but Stripe makes it difficult for ISVs to do these things because, simply put, that’s not what Stripe was built for.

What Has to Change for Adyen, Stripe and Other Players to Compete?

For these new players to settle into this market and actually see success, some major changes need to be made — starting with their product. Adyen, for example, serves up an API-centric solution and lengthy implementation time to larger organizations and enterprises interested in becoming a PayFac. This won’t fly for their new target mid-market software companies, who are specifically looking for a turn-key, whitelabel system with a short time to market.

Another deal breaker for these mid-sized companies is support. For Stripe and Adyen, lacking the human-centric approach has been a known weakness, going back to the idea that these companies don’t have mid-market written in their DNA. For Adyen, they have historically prioritized working with large enterprises who don’t need nor want additional support, since they already offer it in-house.

For Stripe, on the other hand, it’s not profitable or ideal for them to offer full-service support to start-ups who may or may not scale. However, to serve up a strong solution to mid-market ISVs, Stripe would need to rethink how they staff due to the high demand for better customer support, technical support, sales support, and marketing support.

The question that these big players must now ask is: Are they willing to drastically increase their staff, support infrastructure and make changes to their product and business model?

Lastly, Stripe will also need to adjust their margin expectations when it comes to the mid-market. Recently, the provider hiked up pricing for manually entered card payments to account for the higher risks associated with these payments. They claim the increased prices are to counteract fraud, but 50 basis points worth of fraud? Stripe is certainly capable of lowering prices, but are they willing to move them to where they need to be in order to be in line with the target market?

Tilled Was Made For You and M(id-Market)e

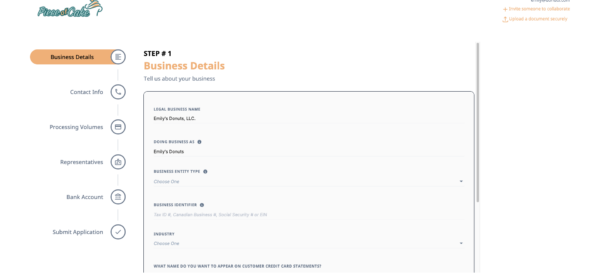

Tilled on the other hand, was purpose-built for the mid-market. Our technology, core integrated payment solution, business model, contracts, support resources, and processes were all designed through a specific customer lens, particular to mid-market ISVs. As a result, we’re able to deliver a turn-key solution to this demographic that allows them to customize and create the payment experience of their dreams.

Want to learn more about how you can customize your own integrated payment solution with Tilled? Reach a member of our sales team here!